Research reveals the number of unclaimed estates in the UK and how you can avoid your estate being unclaimed.

Each year, numerous estates remain unclaimed, with potential heirs either unaware or unable to stake their claims. As of April 2024, there are almost 6,000 unclaimed estates across the UK. If we consider that the average cost of a property in the UK is £281,913, and there are 5,939 such properties, the total estimated value of these unclaimed estates amounts to approximately £1,674,281,307.

In light of this, Weightmans, a leading UK law firm, aim to explore the regions in the UK with the highest number of unclaimed estates, delve into the legal fate of these assets, and uncover the reasons why so many estates remain unclaimed. Additionally, we will provide expert advice on how individuals can safeguard their future inheritances to ensure their legacies do not fall into oblivion.

The Centre of Unclaimed Wealth in the UK

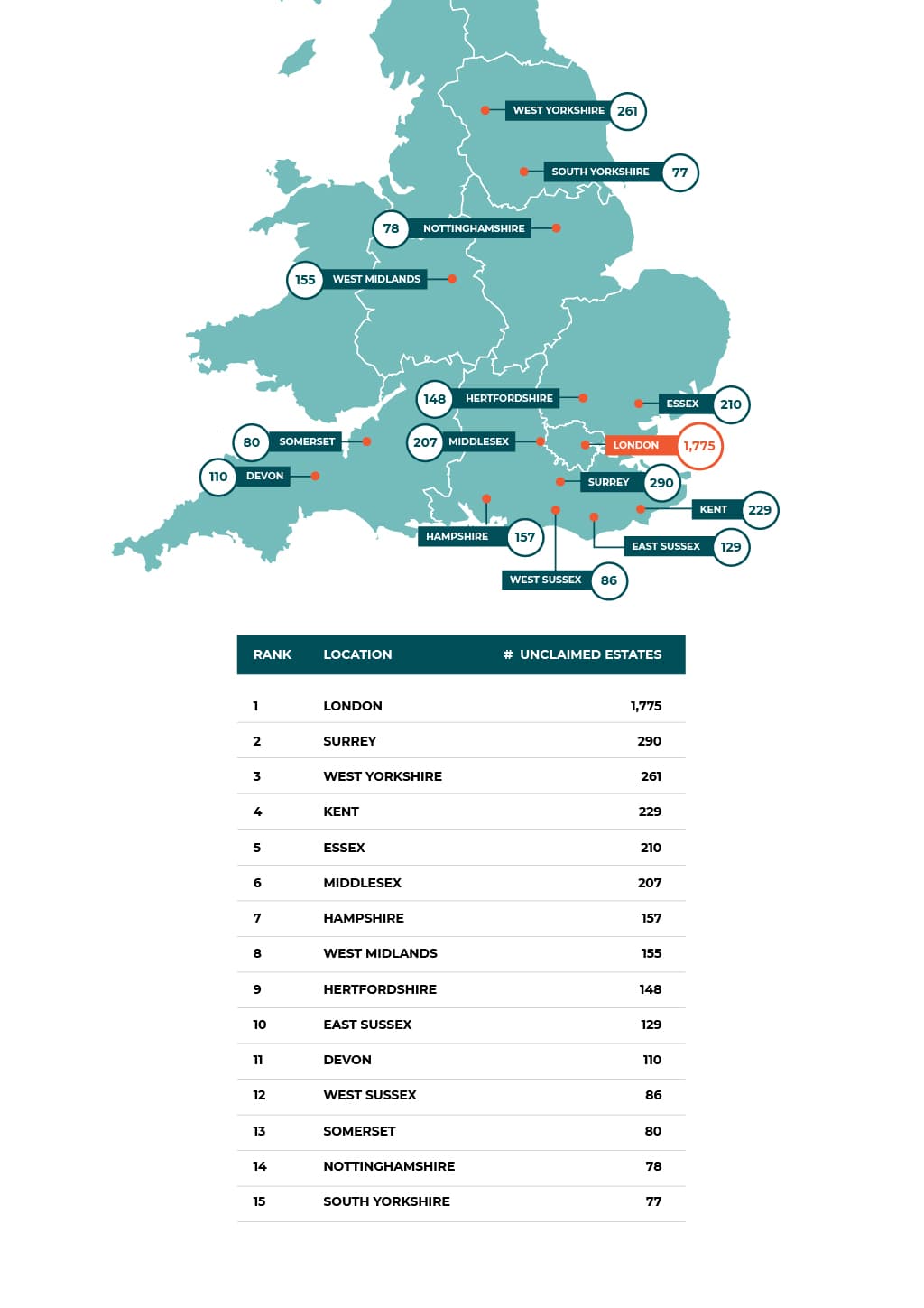

London towers over other UK regions with a staggering 1,775 unclaimed estates, highlighting a significant amount of wealth and legacy left unclaimed in the capital. This high number reflects the vast and diverse population of the city, along with the complexities and anonymity that urban life can foster.

Surrey follows as a distant second with 290 unclaimed estates, suggesting that even in more affluent or less densely populated areas, many assets still fail to reach their rightful heirs.

West Yorkshire takes the third spot with 261 unclaimed estates, underscoring the socio-economic and demographic shifts that can lead to estates going unclaimed in such historic and industrially significant regions.

Kent and Essex round out the top five, with 229 and 210 unclaimed estates respectively. These figures reflect the broader national issue of unclaimed properties which spans both rural and urban settings, across counties known for their distinct identities and histories.

| Rank | Location | Number of Unclaimed Estates |

|---|---|---|

| 1 | London | 1,775 |

| 2 | Surrey | 290 |

| 3 | West Yorkshire | 261 |

| 4 | Kent | 229 |

| 5 | Essex | 210 |

| 6 | Middlesex | 207 |

| 7 | Hampshire | 157 |

| 8 | West Midlands | 155 |

| 9 | Hertfordshire | 148 |

| 10 | East Sussex | 129 |

| 11 | Devon | 110 |

| 12 | West Sussex | 86 |

| 13 | Somerset | 80 |

| 14 | Nottinghamshire | 78 |

| 15 | South Yorkshire | 77 |

| 16 | Dorset | 72 |

| 17 | Berkshire | 71 |

| 18 | Berkshire | 71 |

| 19 | Gloucestershire | 69 |

| 20 | Cheshire | 66 |

| 21 | Bedfordshire | 54 |

| 22 | Cambridgeshire | 52 |

| 23 | Warwickshire | 50 |

| 24 | Suffolk | 47 |

| 25 | Wiltshire | 44 |

| 26 | Oxfordshire | 42 |

| 27 | Northamptonshire | 42 |

| 28 | Buckinghamshire | 40 |

| 29 | Manchester | 9 |

| 30 | Lancashire | 5 |

Most Common Surnames in Unclaimed Estates

The data from the unclaimed estates list reveals that certain surnames appear frequently, suggesting that these names are common in the population or may have higher incidences of unclaimed estates. The most common surname is "Smith," with 103 occurrences, followed by "Jones," "Brown," "Williams," and "Taylor." The high frequency of these surnames in the unclaimed estates' list might reflect their commonality, leading to a higher likelihood of estates being unclaimed when individuals pass away without direct heirs or clear wills.

| Rank | Surname | Occurrences |

|---|---|---|

| 1 | Smith | 103 |

| 2 | Jones | 67 |

| 3 | Brown | 44 |

| 4 | Williams | 43 |

| 5 | Taylor | 37 |

The Fate of Forgotten Fortunes

When someone in the UK passes away without a will and any known heirs, their estate enters the realm of 'Bona Vacantia', Latin for 'ownerless goods'. This legal process is managed by the Bona Vacantia Division (BVD) of the Government Legal Department. The BVD's role is crucial in handling these estates, ensuring that any assets without a clear heir are not left in indefinite limbo.

The Legal Process

The process begins when an estate is reported to the BVD, typically by a solicitor, estate administrator, or even a member of the public who might be aware of the deceased's lack of heirs. Once an estate has been reported, the BVD conducts a thorough investigation to locate any potential heirs. This includes reviewing the deceased's family and financial history and potentially working with genealogists and researchers.

If no will is discovered and no heirs are found after this initial investigation, the estate is officially declared 'Bona Vacantia'. The estate is then listed publicly, providing an opportunity for anyone who believes they might have a claim (usually relatives) to come forward.

Period on the Unclaimed List

Estates can remain on the unclaimed list for a considerable time. There is a general period of up to 30 years during which claims can be made against the estate. This lengthy period allows ample time for potential heirs to discover their claim to an estate and to gather the necessary documentation and legal representation to support their claim.

Eventual Fate of Unclaimed Estates

If, after 30 years, no rightful heir has been identified, the estate permanently reverts to the Crown. The assets are then transferred to the Crown's Nominee, where they are held and may be used for public benefit. This final step ensures that the assets from unclaimed estates are eventually put to use, rather than remaining stagnant.

Understanding this process is essential for anyone who might be researching their family history or suspects they could be the heir to an unclaimed estate. It's advisable for potential claimants to act within the 30-year window and to seek legal advice to navigate the complexities of claiming an unclaimed estate. This not only helps in securing their rightful inheritance but also aids in closing the chapter on the deceased's unclaimed legacy.

Actionable Tips for Ensuring Your Estate is Claimed

Creating a will is the most effective way to ensure that your estate is distributed according to your wishes and to the individuals or entities you care about most. This is especially crucial if you have few or no living relatives, as, without a will, your estate could potentially become unclaimed and revert to state ownership.

In your will, you have the flexibility to specify precisely who should inherit your assets. These individuals or entities are known as the beneficiaries of your will. It’s important to note that beneficiaries do not need to be family members; you are free to include friends, life partners, charities, or other organisations that you wish to support.

You can tailor the inheritance in your will with great precision: you might choose to leave particular items or fixed sums of money to certain beneficiaries, or you might decide to allocate percentages of your estate’s total value to different parties. This flexibility allows you to acknowledge and provide for the people and causes important to you in meaningful ways.

By ensuring that your will is professionally drafted, you can avoid any ambiguity regarding your intentions. A clear, legally sound will eliminates uncertainty for your loved ones and simplifies the estate administration process, ensuring that your final wishes are honoured exactly as you envisioned. Thus, not only does a well-prepared will secure your legacy, but it also provides peace of mind to those you leave behind, knowing they are fulfilling your wishes without room for doubt or legal challenge.

"Creating a will is more than just a legal necessity; it's a critical component of financial wellness," explains Richard Bate at Weightmans. "Without a clear will, you're leaving the fate of your assets up to the courts, which can lead to long, stressful disputes among your potential heirs."

By taking proactive steps in estate planning and utilising available resources, individuals can significantly reduce the chances of their estates becoming unclaimed. Ensuring that your final wishes are clearly documented and legally protected not only secures your legacy but also eases the burden on your loved ones during a challenging time.

For guidance on making sure that your estate is passed on as you wish, contact our will writing solicitors.