A new survey from Weightmans has found that nearly 1 in ten Britons have over £1,000 hidden in secret savings from their partners.

Key Survey Findings:

- 17% of Brits say their partners have lied about debt

- 9% of Brits have over £1,000 hidden in secret savings from their partners

- 20% of Brits say they argue with their partner once a month about finances

- 24% of Brits say they don’t know how much their partner earns

- 20% of Brits say they’re fairly likely to leave their partner if they committed financial infidelity

- 31% of couples say they have a credit card their spouse is unaware of

A new survey from law firm Weightmans has found that nearly one in ten Britons have over £1,000 hidden in secret savings from their partners. This follows on from data revealing that searches across the UK for ‘financial infidelity’ have increased by 45% from 2022 to 2023.

This is largely due to the growing financial pressures Britons face due to the cost of living crisis; which is forcing some couples to keep debts, purchases and income a secret from their partner. Following this trend, Weightmans has explored the state of financial infidelity across the UK and unveiled the telltale signs your partner may be committing financial infidelity.

What is financial infidelity?

Financial infidelity occurs when one partner in a relationship lies about, hides or misrepresents financial information. This could involve: lying about savings, lying about debts, keeping a secret bank account, intentionally keeping purchases secret, hidden gambling and more.

Financial infidelity is a form of dishonesty that can not only affect the financial stability of a relationship but also the trust between two partners. It can damage a relationship in many ways, for example leading to arguments, with 20% of respondents saying they argue with their partner once a month about finances. In some cases, financial infidelity can lead to the dissolution of a relationship and even divorce, with 20% of respondents saying they’re fairly likely to leave their partner if they committed financial infidelity.

Financial infidelity across the UK

The most common type of financial infidelity across the UK is lying about debt

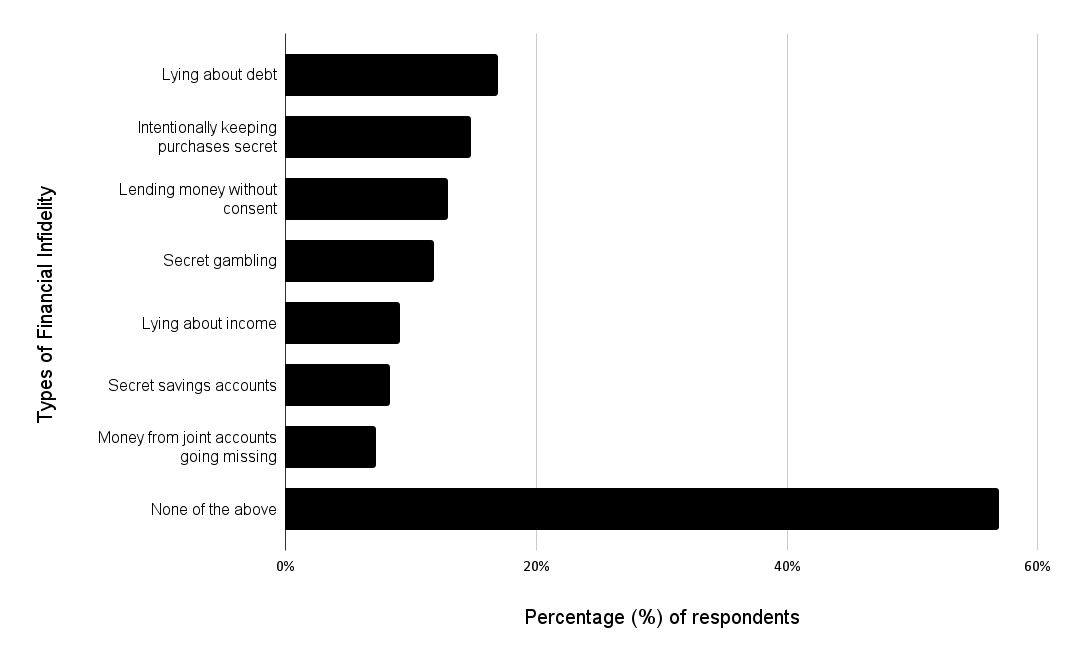

Our survey has revealed some financial secrets are more prevalent than others. We asked respondents ‘Which, if any, of the following kinds of financial infidelity has occurred in your relationship?’

- Lying about debt

- Intentionally keeping purchases secret

- Secret gambling

- Lying about income

- Secret savings accounts

- Money from joint accounts going missing

Among these, lying about debt is the most common form of financial infidelity, with 17% of respondents saying this has occurred in their relationship. Following this, intentionally keeping purchases secret (15%) and lending money without consent (13%) are the second and third most common forms of financial infidelity across the UK. Further results revealed in 12% of relationships across the UK secret gambling occurred, in 9% partners lied about their income, in 8% partners had a secret savings account and in 7% money from joint accounts went missing.

Whilst lying about debt is the most common form of financial infidelity, 8% of respondents admitted to having secret savings accounts — but just how much do they have stashed away?

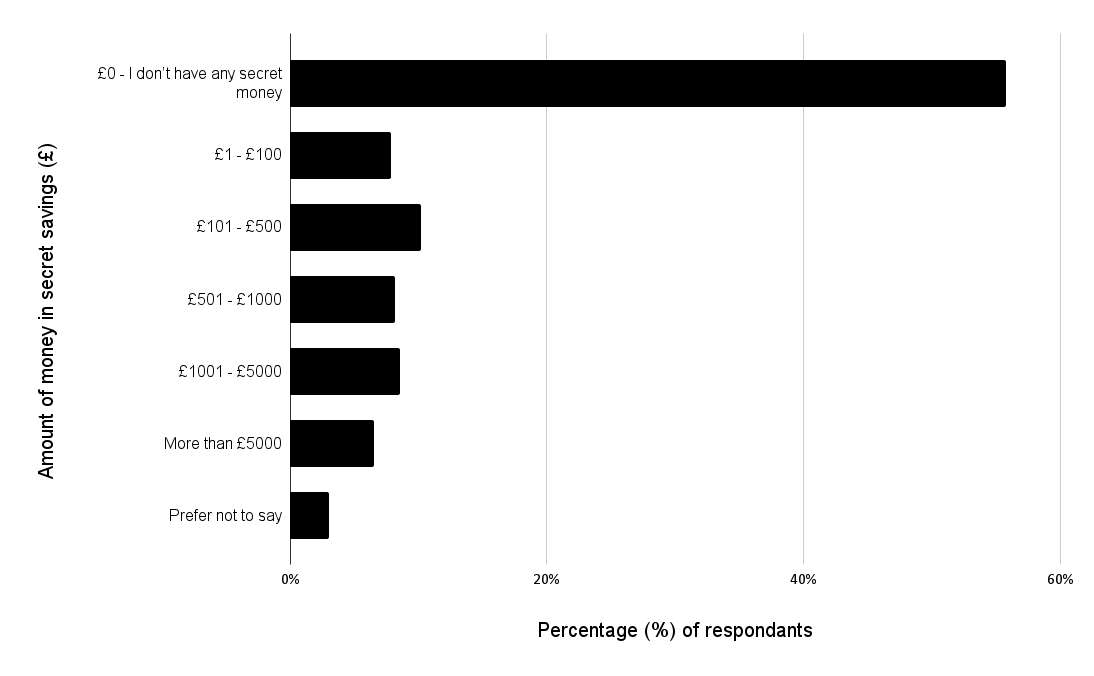

Whether it’s for financial independence, surprises or concerns about your relationship, having a secret savings account is more common than you might expect. Our survey has revealed nearly one in four Brits have over £500 hidden from their partner in secret savings. We asked respondents ‘How much money, if any, do you have ‘stashed’ away that your partner doesn't know about?’

Following this, 8% of respondents said they have between £1-100 in secret savings; 10% of respondents said they have between £101-500 in secret savings; 8% of respondents said they have between £501-1000 in secret savings; 9% of respondents said they have between £1001-5000 in secret savings and 7% of respondents said they have more than £5000 in secret savings. Highlighting the impact the cost of living is having on trust and transparency in relationships.

Financial infidelity vs financial irresponsibility

Not all issues arise from financial infidelity. Poor financial decision making during a marriage can also have profound implications on a divorce as it can result in a lower financial settlement.

Financial transparency is important for a healthy relationship, as is making sure that there are regular discussions during the marriage to review finances and investments. You can then be confident that everything remains on track – or at least that decisions are made together for which joint responsibility can be taken.

How does this look across UK regions?

Over one-half of Londoners in a relationship admit to having secret savings accounts

Our survey has revealed that 57% of Londoners and 50% of Northern Irish couples admit to having secret savings accounts. Furthermore, It’s no surprise that due to the cost of living in London, 16% of Londoners in a relationship have over £500 hidden from their partners in secret savings, which is higher than any other UK region.

Whilst secret savings accounts are prevalent across some regions, which UK regions find themselves lying about debt the most?

When it comes to lying about debt, Northern Ireland has the highest percentage of respondents saying this has occurred in their relationship (28%), followed by Yorkshire and the Humber at 21%.

Debt, savings accounts and finances, in general, can often be tricky topics to discuss and can often lead to arguments and disputes…

With this in mind, when it comes to arguing about finances, 42% of couples in Northern Ireland argue with their partners once a month. Following this, one in ten couples in the North East of England argue about finances more than once a week. However, 42% of respondents in Scotland and the South West of England say they never argue with their partners about finances, compared to a mere 24% in London — highlighting the effect the cost of living in London has on relationships.

Five signs your partner may be committing financial infidelity

Your partner is private about finances: When it comes to being in a relationship (especially if you’re either married or in a civil partnership), both parties must be honest and transparent about finances. If one party in the relationship is private about finances, it could indicate that some form of financial infidelity has taken place — it’s important not to panic in these situations as the offence could be very minor. In this case, an open line of communication and discussing your concerns with your partner is extremely important.

Your partner has a secret bank account: If you suspect or are certain your partner has a secret bank account it’s important to discuss this with them. Although many couples may keep finances separate, it’s very concerning if one party is keeping bank accounts secret and this could imply there needs to be more communication and transparency in the relationship.

You and your partner have different financial priorities: In relationships, there are often differing financial priorities, which can cause stress on the relationship. For example, one person favouring saving and the other shopping. If this occurs, it could lead to members of the relationship hiding finances and being secretive to avoid disputes.

Your partner stonewalls financial topics: If your partner avoids financial conversations and these conversations cause them lots of anxiety and stress, there may be further issues that you’re unaware of. This could indicate your partner is having financial difficulties and potentially committing financial infidelity.

It isn’t clear what your partner's money has been spent on: Although no one likes to be micromanaged in a relationship, if you’re sharing expenses and spend a lot of time with your partner but are unaware of where they’re spending their money, this could indicate they’re not being transparent with their finances and financial infidelity is being committed.

Emma Collins, National Head of Services for Individuals and Family at Weightmans comments:

"As our survey reveals, unfortunately, financial infidelity is evermore present in 2023 as external pressures such as cost of living play havoc on modern relationships. This deception not only breaches the trust upon which relationships are built but may also result in legal disputes, particularly when large sums or significant debts are involved without one partner’s knowledge.

Recognising the signs of financial infidelity can play a critical role in not only preserving the relationship but also protecting both parties from potential legal consequences. Debt can impact on credit rating and lead to issues such as repossession of a home or even bankruptcy. Transparency can mitigate the risk of financial deception escalating into a legal dispute, safeguarding their relationship and both parties’ financial integrity.

In the event of a separation or divorce, full financial disclosure is required and discovering undisclosed debts or assets can complicate proceedings and make settlement harder to achieve.

When entering into any relationship, we advise that both parties undertake thorough financial planning and engage in candid discussions about their financial situations, without judgment, to prevent the potential for future secrecy.”

How to overcome financial infidelity

- Communicate: discuss your opinions and financial priorities to rebuild trust

- Tell the truth: if you make a mistake with money, it is better to share than try and get out of the problem alone

- Create a budget: stick to it! Having a set budget allows you to spend freely without guilt.

Methodology

The research was conducted by OnePoll, with 2,000 respondents, who are aged 25-64 and are in a relationship across the UK (between 06.10.23 – 12.10.23).

OnePoll are members of the British Polling Council and is an MRS Company Partner. All MRS Company Partners and their employees agree to adhere to the MRS Code of Conduct and MRS Company Partner Quality Commitment whilst undertaking research.

If you need guidance on any family law issues, contact our family law solicitors.

A version of this article was first published on 15 Nov 2023