A look at the ways in which you can structure your company and some of the reasons for, and potential tax benefits of, using group structures.

Businesses come in a variety of forms ranging from sole traders and partnerships to large multi-national corporations and, as ever, there is no one size fits all approach.

What is a group structure?

A group structure is created when a company (directly or indirectly) owns one or more other company.

The company at the top of the structure is called a parent or holding company and can have several subsidiaries beneath it.

All companies in the group are under the ultimate ownership and control of the parent company.

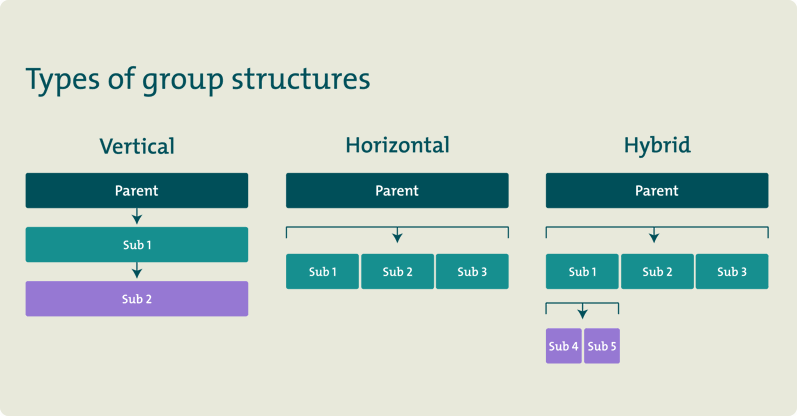

Types of group structures

Group structure examples

Group structures can themselves take a variety of forms, from a horizontal structure, vertical structure to various forms of hybrid structures (examples of which are illustrated below).

Alternatives to group structures

An alternative is to form a separate standalone company or companies that are owned by the same (non-corporate) shareholder or group of (non-corporate) shareholders.

In that case, the companies are associated (sometimes referred to as 'sister companies'), being under the common control of an individual or group of individuals, but they do not form a group.

Another alternative is to organise the business into divisions within a single company.

What are the benefits of a group structure?

So why form a group as opposed to simply creating a division or setting up a separate entity?

There can be a range of potential commercial, regulatory, legal and tax benefits in forming a group but perhaps the most common rationale for doing so is the management or mitigation of risk.

Ringfencing assets and liabilities

A subsidiary company can be used to ringfence assets or liabilities, each company within the group having limited liability.

If, for example, you want to expand into a new product or market, using a subsidiary can ensure that the assets of the existing business are safeguarded and are protected from any liabilities that may arise in relation to the new venture. A divisional structure cannot provide such protection.

As well as ringfencing financial liabilities, the use of a separate group company can also assist diversification and allow the new venture to build its own brand or reputation (albeit with such support as may be required from the existing business).

A group structure can therefore also help to protect against reputational and commercial risk.

That is not to say that the use of a group structure can always ringfence all commercial risks and liabilities as, from a practical perspective, this may not be possible.

For example, lenders and suppliers may require the parent company to guarantee or underwrite the subsidiary’s liabilities. However, even in those circumstances, the risks and liabilities are nevertheless generally restricted and quantifiable.

Whenever moving assets around a group, as opposed to acquiring new assets where the assets can be acquired directly into the relevant holding company, care is required to ensure that creditors are not being prejudiced.

Whilst assets that tend to appreciate in value, such as property and intellectual property, can generally be transferred to another group company at their book value rather than market value, if they are not transferred at market value and the transferring company runs into financial difficulties the transfer is likely to be reviewed and an application could potentially be made to set it aside by the administrator or liquidator (or other affected party, such as creditors).

A sale of the assets (at market value) and leaseback to the trading company may be an alternative option that would help to protect against such insolvency risks.

In summary, forming a group and moving assets such as property and IP out of the trading company into a new holding company (or separate asset holding company in the group) can help to protect or ringfence those assets going forward but requires careful planning and advice.

Regulatory benefits

The use of a separate subsidiary company to carry out different activities or hold certain assets (such as intellectual property) can also help from an administrative or regulatory perspective.

Certain regulatory authorisations can, for example, be extended to cover other group members (and in many cases the process for doing so is either automatic or truncated to reflect that there is common control and the group from an economic perspective effectively forms one consolidated whole).

Centralised functions/assets

Another use of group structures is to provide a central holding point for certain functions or assets.

If, for example, the business occupies a number of sites or properties, a group company can be formed to hold all the property assets (and to lease or licence the properties as required to the other relevant group members.

Similarly, if the business involves the exploitation of IP across a range of markets or products, an IP holding company can be used which then grants licences of the IP (restricted as necessary to the relevant product of market) to the group companies.

This ensures that if a business wants to divest of any particular product/division and it is organised in a group structure it can do so on a relatively straightforward and cost-efficient basis by disposing of the relevant subsidiary which only holds the IP rights that it needs. The rest of the IP rights are kept within the retained group.

Tax benefits

One of the key advantages of a group structure as opposed to operating through the use of sister companies is that, subject to certain conditions being met, groups of companies are afforded a number of tax exemptions and reliefs in relation to transactions between group members.

For example, certain tax losses and reliefs can also be utilised across the group rather than just in the company in which they arise. These reliefs do not generally apply to sister companies.

Transfers of tangible assets between companies within the same group for UK capital gains tax purposes are also deemed to take place on a tax neutral basis (regardless of the price at which they are actually transferred) allowing the easy transfer of assets between group companies.

There are also, subject to certain conditions being met, exemptions from UK corporation tax in relation to profits from a disposal of shares in a subsidiary and reliefs from stamp taxes on the transfer of shares and properties between group members.

Dealing with sale proceeds of a business

A look at the personal estate planning issues which arise following a sale and the tax implications of selling your business.

Dealing with the sale proceeds of a businessWhat are the disadvantages of a group structure?

Whilst we have looked at some of the advantages of a group structure there are some potential disadvantages that will need to be considered and weighed against the benefits. These range from increased complexity and compliance costs (from preparing accounts to tax returns for each group company) to some potential tax disadvantages (for example the small profits rate for corporation tax purposes whereby the companies with profits of £50,000 pay corporation Tax at 19% is divided by the number of associated / group companies). One issue that requires particular care is having a mix of trading and investment activities within the group as this can lead to certain tax reliefs such as Business Asset Disposal Relief (referred to above) for capital gains tax and Business Relief for inheritance tax purposes being lost or restricted. It is therefore important that tax advice is always sought before forming a group.

Holding assets outside the group

Another question that arises is whether to hold assets such as properties or intellectual property within or outside the group.

Ultimately this depends upon a variety of commercial and tax considerations and the precise individual circumstances.

Separate income stream

Holding income-producing assets outside the group can provide an income stream for the owner.

For example, holding the trading property from which the business operates outside the group in the personal hands of the shareholders or pension funds allows the shareholders to extract an income stream from the business by charging rent (and the company will be able to claim a corporation tax deduction for such rental payments).

Similarly, if any IP is held personally it can be licensed to the group. Any such rental/licence charges should be on an arms-length basis.

No shared ownership

Holding certain assets outside the group also ensures that if the ownership base is subsequently diversified so as to include employees and investors etc they do not acquire any direct interest in the assets concerned which remain within the personal ownership of the relevant shareholder(s).

Impact on sale

The impact of holding assets outside the company/group also needs to be considered in the context of any future sale and the likely requirements of any potential buyer.

If the intellectual property is essential to the business or the nature of the business is such that the premises are integral to the business, so that the buyer will either require the shareholders to also sell them the IP or property or grant a new licence or lease to the company/group prior to the acquisition, the likely costs and tax impact of this will need to be assessed.

For example, the associated sale of a trading property held outside the group cannot qualify for Business Asset Disposal Relief to the extent that a market rent has been charged by the shareholders to the company.

The buyer is also unlikely to bear any tax costs associated with the grant of any new lease or licence or otherwise in putting the assets back into the company/group (this having been a personal choice of the shareholder(s)).

Holding assets outside the group, particularly those assets which are necessary for the proper operation of the business, could therefore potentially increase the overall tax (and costs) payable on any sale and this needs to be weighed against the benefits of providing a separate income stream and ringfencing the ownership of such assets (although there are potential ways this can be achieved within the company/group by way of the relevant class rights attaching to the shares).

Pension funds

Holding assets within a pension scheme rather than personally could potentially ameliorate some of the tax costs in that:

- any income stream will not be subject to tax within the pension fund; and

- any gain on a sale of the assets by the pension fund will also be tax-free.

If assets are held outside the group within a pension fund there are, however, other practical issues and complexities to consider.

The relevant trustees will have separate fiduciary duties and need to act independently. They will, therefore, need to ensure that they are receiving full market value for the rental/licensing of any assets to the group and in relation to any sale of assets held by the pension fund. This may entail separately negotiating the terms of sale of any assets to any buyer (and any warranties and indemnities to be provided to the buyer).

The ability to access the pension funds are also restricted and the relevant annual and lifetime limits will also need to be considered in relation to any initial contributions to the pension fund of the relevant assets.

Another practical issue to be aware of is that if a property asset within a pension scheme is held for the benefit of more than one pension scheme member, difficulties can arise if one member wishes to draw his benefits or take a transfer payment and the scheme has insufficient liquid assets to pay. Sometimes it will be necessary to sell the property.

Agreements can be put in place at the time of the property acquisition to address certain issues, for example by conferring pre-emption rights for the benefit of the remaining members.

Conclusion

There are a number of reasons why a group may be formed many of which are concerned with the management of risk.

For more insights into the practical issues faced by owner managed businesses, see our articles on shareholders' agreements, employee share ownership and family ownership.

If you have any questions about company structures or need advice, contact our tax solicitors.

A version of this article was first published on 23 May 2018