Learn what a cap table is, why it matters, how to create one, and access our free downloadable template to help you get started.

Capitalization tables (typically shortened to ‘cap tables’) are an important tool for business owners to help keep track of how many shares they and their investors have in the company.

In this guide, we’ll outline what you need to know about cap tables and provide you with a free template to get started.

What is a cap table?

A cap table is a record of the ownership structure of a company. It shows who the shareholders in the company are, how much equity they own and any other securities they hold (such as share options, or warrants).

The main purpose of a cap table is to give visibility and clarity to the company’s ownership structure. This helps shareholders to know where they stand and provides clarity for prospective investors in the business.

How to create a cap table

If your business is an early stage startup, it is likely that your cap table will initially be a simple document, though they often become much more complicated over time, particularly if you have several rounds of funding involving different classes of shares.

Initially, many business owners create their cap table in Excel or Google Sheets.

You can start to create your cap table by collating the following information:

- The valuation of your business

- The number of shares in issue

- The names of the founders and their respective ownership stakes

- The names of any other shareholders (including external investors) and their ownership stakes

- The types of shares held by each investor

- The number of share options the company has granted (or has authority to grant)

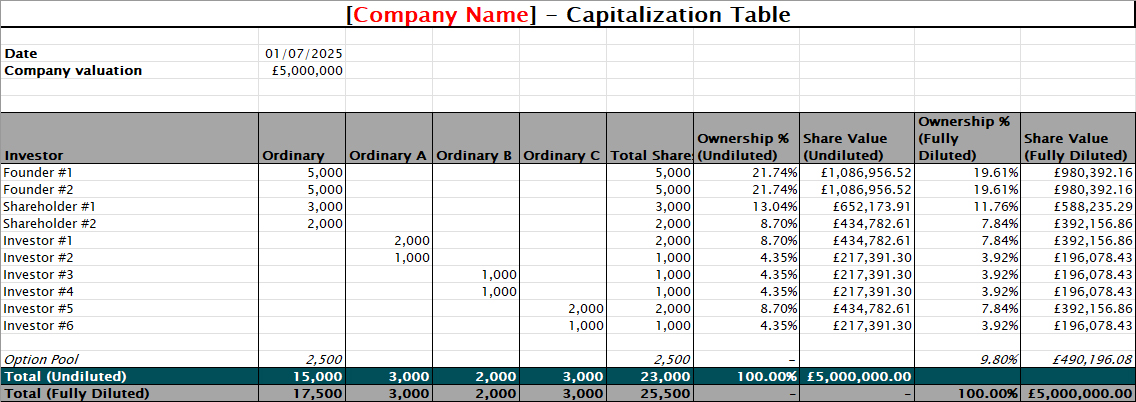

Cap table template

Download our template to help you get started with creating your first cap table.

How cap tables are used

Once you have created your cap table, there are a few key ways that you can use it.

Financial modelling

A cap table can help you model how changes to equity distribution will affect your equity stake or those of your existing investors. For example, you can see how a series of funding or providing employee share options would affect equity distribution on a sale of the business.

Existing investor relations

Your cap table provides transparency to existing investors on their stake in your business.

Fundraising

When seeking capital from additional investors, you can use your cap table to showcase your current ownership structure and model how they would fit into it.

Updating your cap table

You should update your cap table any time there is a change in the valuation or shareholding of your business.

You will need to update your cap table when:

- Your business valuation changes

- You get new shareholders

- You go through a funding round

- You offer share options to employees

- Any debt is converted to equity

Frequently asked questions on cap tables

Are cap tables public information?

No, cap tables are not public information and will contain sensitive information about your company and your investors. It is worth noting, however, that UK companies are required to provide updates on their shareholders (including names and number/class of share held) as part of their annual confirmation statement filing at Companies House, which is publicly available.

If you wish to share your cap table with someone who isn’t part of your company or a shareholder in the company, such as a prospective investor, you should ensure that you have first taken appropriate legal safeguards, which may include the signing of a non-disclosure agreement.

Is a cap table legal binding?

No, a cap table is not a legally binding document. The cap table serves only as a record of ownership and equity distribution.

Founders’ and shareholders’ legal rights will instead by protected through documents such as shareholder agreements and investment agreements.

What is the difference between a cap table and a ‘waterfall’?

The terms cap table and waterfall are sometimes used interchangeably but there are some distinctions between the two.

As we have explored, a cap table provides a record of ownership and equity distribution.

A waterfall contains a wider information such as outstanding debt and other securities, as well as accounting for differing return rights for different classes of shares. A cap table will feature as a constituent part of the waterfall. A waterfall is also used in connection with any sale of the company as an indication of how much proceeds an individual shareholder will receive on a sale of the company at differing valuations.

Is a cap table the same as a balance sheet?

No, a cap table and balance sheet serve different purposes and provide different information on the financial position of a business.

A balance sheet provides a list of a company’s income, expenditure, assets, liabilities and equity, whereas a cap table only provides a breakdown of ownership and equity distribution.

Does a cap table include debt?

A cap table does not typically include debt. However, there are some potential exceptions to that. Debt may be included in the cap table when the debt takes the form of convertible debt, such as convertible loan notes, which may later be converted into equity.

What is a fully diluted cap table?

A fully diluted cap table is a cap table that outlines all securities that could convert to equity, such as outstanding share options, warrants or convertible loan notes. Most cap tables (such as our template cap table above) show ownership percentages on both an undiluted and fully diluted basis.