We provide guidance on all aspects of a financial consent order and explain how you can apply for one.

What is a consent order?

A consent order is a legally binding document sealed by the court that sets out the terms of a financial agreement reached between parties in divorce or dissolution proceedings. This can be as complex or as brief as is required by each couples’ individual circumstances.

The guidance given to couples considering divorce or dissolution on the gov.uk website does refer to the need to obtain a financial order to make a financial settlement legally binding and therefore enforceable if one party defaults, but it does not explain that this is not the only reason why a financial order is crucial. Unfortunately, many people do not fully appreciate the need for an order, especially if an agreement is reached and no difficulties are anticipated in putting practical arrangements in place.

Why is a financial consent order important?

Enforcement

An agreement embodied in a court order is important in the event that one party defaults on the agreement. If the agreement is contained within an order, parties can apply to the court for this to be enforced. Without such measures, it may be difficult to hold an ex-spouse to an agreement reached.

Future claims

However, equally crucially, If your claims are not formally dealt with in an order, which includes a clause to record that all future claims are dismissed, your spouse or partner may be able to bring a case against you in the future, even many years after the divorce or dissolution has been finalised.

In the case of Wyatt v Vince, the wife issued her claim 19 years after their divorce was finalised. At the time of the divorce, the couple were virtually penniless, and they took no action in relation to resolving the financial aspects upon their divorce. In their minds, there was nothing that needed to be sorted out.

In the years following the divorce, the husband built up a multi-million-pound business. The wife was entitled to bring a claim as no order had been made previously to prevent her from doing so.

Although she did not succeed in getting a large award, the court found that she was able to proceed with her claim despite the years that had passed since their divorce. An agreement was ultimately reached between the parties which provided the wife with a lump sum of £300,000.

For many people, there is a future anticipation of an inheritance or chance of receiving a windfall such as winning the lottery. Without a financial order in place dismissing the right of a former spouse to bring a future claim, parties may find themselves faced with a financial claim.

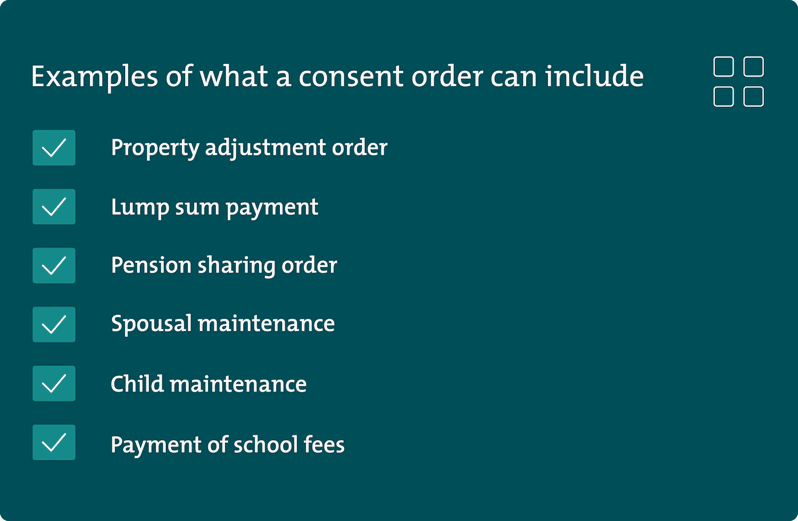

What can a consent order include?

A consent order can be uniquely tailored to suit your individual circumstances and can cover any of the below:

- Property adjustment order: This involves the transfer of a property to one party. Sale of a property

- Lump sum payment: Payment of a cash lump sum by one party to one party.

- Pension sharing order: Pension sharing is when a share of one spouse’s pension is transferred to the other. See pension sharing on divorce

- Spousal maintenance: payments from one party to the other as income. Quantum and duration of payments depends on the circumstances of the case.

- Child maintenance: payments from one party to the other as income for the benefit of any children. Child maintenance is predominantly governed by the Child Maintenance Service (CMS) however there is a maximum threshold. If the paying party earns over £156,000, the court will retain jurisdiction and can make orders as to the amount of maintenance payable. See how to calculate child support

- Payment of school fees: this can cover nursery, primary, secondary or university education. See disputes about payment of nursery or school fees and funding your child's further education.

A consent order is divided into two parts: the first section is the preamble which contains recitals and undertakings and the second is the formal court order.

A recital records the background to the matter and any agreements you and your partner may have reached which cannot be ordered by the court (for example, the division of household belongings).

An undertaking is a solemn promise to the court, which can be enforced by committal proceedings, often involving a third party who is not party to the proceedings (e.g. a bank if the parties intend to transfer a bank account from joint names to one party).

When do I apply for a consent order?

In order to apply for a consent order, you must have started divorce or dissolution proceedings.

Depending on whether these were instigated before or after April 2022, you must have reached either Decree Nisi or Conditional Order within your divorce.

How do I apply for a financial consent order?

The court will not draft an order for you — you need to present a draft order for the judge to review and if satisfied, the court will approve it and make into a binding court order for you.

It is important to properly draft a consent order with legal input, to ensure that all aspects of your agreement are recorded and to dismiss the risk of future claims being brought. Since April 2022, parties must apply through the online portal by submitting two documents:

- Draft consent order; and

- Short financial summary called a statement of information (D81)

A solicitor can prepare these for you.

How long does it take?

You must have reached Decree Nisi or Conditional Order within your divorce or dissolution proceedings before you can ask the court to make a financial order.

Once you have reached this point, the draft financial order can be submitted to the court with the statement of information form (D81). This is a snapshot of your finances as there are now (before the order takes effect) and which explains the effect of the order on your respective financial positions.

These documents provide the judge with sufficient information to assess whether the agreement you have reached seems fair and reasonable, and so to approve the agreement you have reached.

The time taken for the court to approve the order depends upon the court’s workload (which varies across the country) and current backlogs. However, it usually takes a few weeks.

Is full financial disclosure required?

Full financial disclosure is not a requirement, save for the D81 as discussed above. The difference between the D81 and full financial disclosure is that neither party needs to provide supporting documentation to the other or to the court to show the figures provided are accurate. However, if there are any questions about how figures have been reached or documentary confirmation is required, you can ask the other party for details before finalising your agreement. It is important to fully understand the context of your family finances and so be able to weigh up whether the agreement you have reached seems fair.

Although full financial disclosure is not a requirement, it is often not advisable to enter into a financial agreement without this. Indeed, a solicitor will not be able to advise you fully as to the terms of the agreement without having had sight of this and they may ask for you to sign a disclaimer to confirm that you understand this and agree to waive the requirement for full disclosure.

How much does a financial consent order cost?

Both parties are advised to seek independent legal advice on the terms of the proposed consent order and to have legal help in the drafting of this, which will vary depending on the complexity of the case and the solicitor dealing with the case.

In addition to any legal fees, there is also a court fee, currently £53.

Will the court always approve the order?

The court will usually approve an agreement reached between the parties provided that it is fair. The court will consider the factors set out at section 25 of the Matrimonial Causes Act 1973.

If the court feels that the agreement may be unfair or requires further clarity, they may raise some questions before approving the order. The court will, however, be “heavily influenced by what the parties themselves have agreed” (Baroness Hale in Sharland v Sharland).

Will I have to go to court?

Parties are not required to attend court when filing a Consent Order. Any questions the judge has in relation to the proposed order will usually be sent from the court by email and court-required attendances are unusual.

For further information on calculating your divorce settlement and issues to consider, see our settlement agreement calculator.

Frequently asked questions

How long is a consent order valid for?

A consent order is not a time limited document and therefore remains in force. Some aspects of the order may be capable of variation (such as maintenance) but the terms of the order remain in place until and unless an application is made to vary this and a further order is made by the court.

We don’t have any assets. Do we still need a consent order?

As set out in the case of Wyatt v Wyatt above, it is important that your financial claims against one another are brought to an end, even if you do not currently have any assets. Without a court order, claims remain open and your circumstances may change in the future, leading to an application being brought by your former spouse

What is the difference between a financial consent order and a separation agreement?

A separation agreement is not a legally binding document. Although a separation agreement sets out your respective intentions, it is always possible for a claim to be brought in the future as your financial claims against one another remain open. It is likely that the court would be guided by the terms of the separation agreement, but the Judge retains discretion as to what a fair division of assets would be. As such, we always recommend a financial consent order, rather than a separation agreement, to provide certainty and peace of mind.

If you'd like guidance on any aspects around a financial consent order and what it entails, please speak to one of our expert family law solicitors.