Learn what financial remedy proceedings are, what happens at them, the types of orders that can be granted and what the financial remedy process looks like.

What are financial remedy proceedings?

Financial remedy proceedings are a legal, court-led, process to sort out your money, property and other resources with your former spouse or civil partner. This could involve dividing up assets such as your house, savings and investments, and pensions. It can also involve assets held abroad, in a business structure or in trusts.

In some cases, the parties will be able to agree on a financial settlement and, in those circumstances, the agreement should be made legally binding by having a consent order approved by a financial remedy judge.

Where the parties cannot agree, one party may decide to start financial remedy proceedings so that the court may assist in determining a fair financial settlement.

The court will resolve any financial issues between the parties to a marriage such as dividing pensions, dividing capital or awarding any spousal maintenance. In doing so, the court will seek to reach an equitable settlement between the parties.

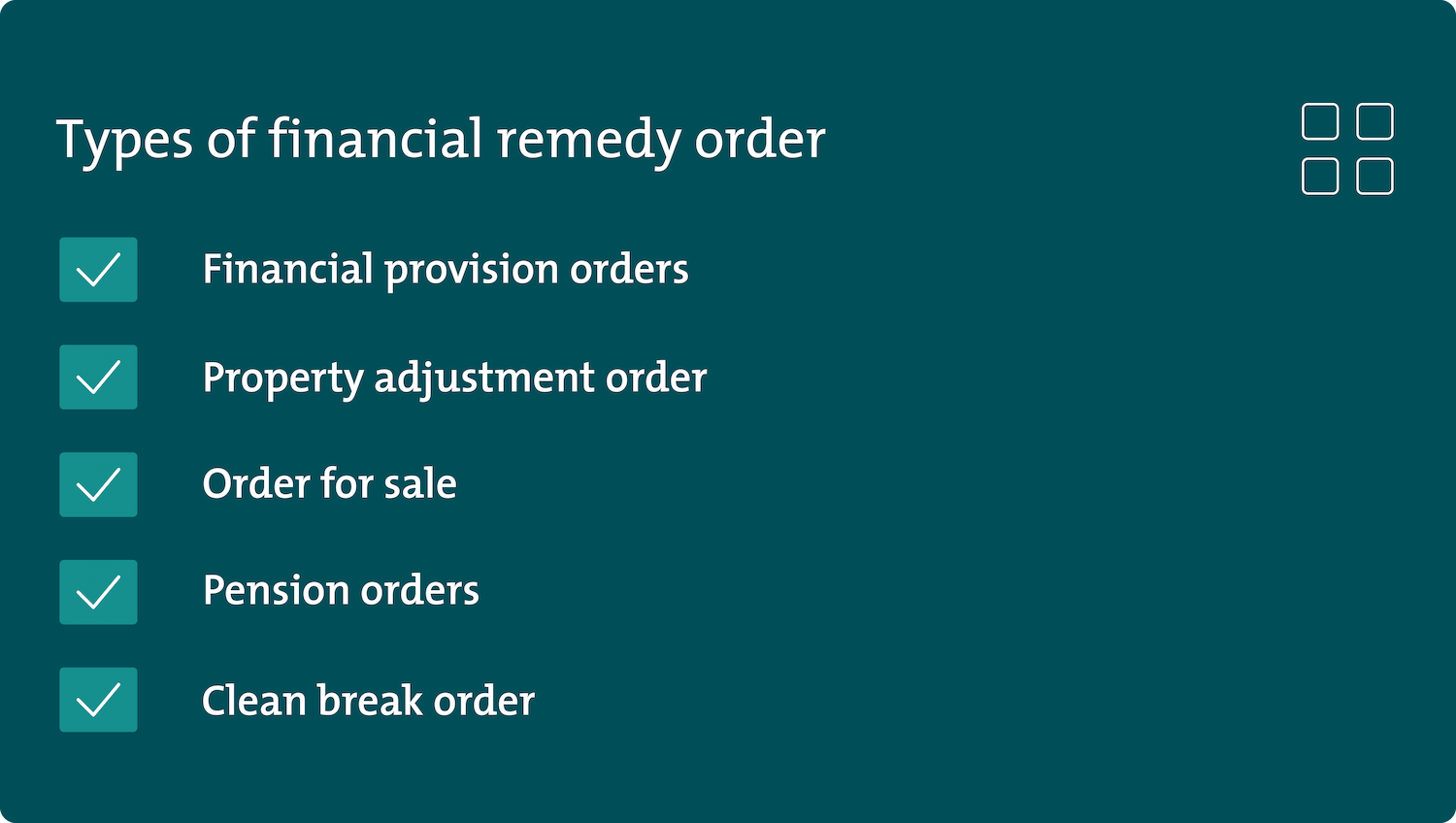

What types of order can the court grant?

If an agreement can’t be reached outside of court, a judge will issue a financial remedy order. A financial remedy order is a type of order that outlines a judge’s decision on how finances are split within financial remedy proceedings.

At the end of proceedings, the judge will make an order which sets out the terms of the settlement. The order is based on either an agreement reached by the parties, or made by the judge if they can't agree.

Below are the types of order a financial remedy order will commonly include:

Financial provision orders

Maintenance

These orders can include an order for periodical payments, which are regular maintenance payments from one party to the other. An order for periodical payments can be specified to last until the other party remarries, passes away (known as a joint lives order) or it may be made to finish on a particular date (known as a term order).

Secured maintenance

Other financial provision orders include secured periodical payments which use existing assets (e.g. the family home) as security to ensure that the periodical payments are made.

Lump sum

The court can also make what is known as a lump sum order which orders one party to make the other a one-off capital payment (sometimes paid by instalments or as a series of lump sums).

Property adjustment order

This is an order for transferring property from one party to another, or to a child of the family. This could include transferring assets such as the family home, car or shares in a business.

Order for sale

The court can order a party to sell specified property to which the other party is beneficially entitled. The proceeds of the sale are then more easily dividable between the parties.

Pension orders

This may include a pension sharing order or alternatively a pension attachment order.

Clean break order

A clean break order states that the court is not making an order to decide how a specific asset is divided.

In simple terms, it clarifies that there are no ongoing financial ties between a separating couple. A clean break order prevents any future claims from being brought.

What does a court take into consideration?

The court will take into consideration all the circumstances of the case. The first step of the court will be to determine how much is in the ‘marital pot’. This is purely an accounting exercise to determine exactly how much the couple have at their disposal financially and following this, the court will commence the process of determining an equitable division of the assets.

The court will prioritise the welfare of any children and then the needs of the parties involved.

The court will also consider relevant legislation. For couples getting divorced, the court will follow section 25 of the Matrimonial Causes Act 1973. For those dissolving a civil partnership, the court will refer to Schedule 5, Part 5, paragraph 21 of the Civil Partnership Act 2004.

The factors that the court will consider are:

- Financial resources

This includes the current income, future earning capacity and property (such as houses or cars) that each of the parties has or is likely to have in the foreseeable future. - Financial needs and obligations

This covers what each party will need to cover things like housing costs and childcare expenses. - Lifestyle before separation

The court will consider the standard of living that each party enjoyed prior to the separation. - Age and length of marriage

The age of each party and how long the couple were married or in a civil partnership will be factored into the financial settlement. - Health factors

Any mental or physical disabilities that affect either party's ability to work or live independently will be considered. - Contributions to the marriage

This includes both financial contributions and non-financial contributions, such as raising children or managing the household. - Conduct

If the court considers one party's behaviour to be egregious, they will consider it when dividing the assets. - Loss of future benefits

The court may consider any benefits (such as lost inheritance rights) that either party will lose the chance of acquiring.

For more information on how these factors may impact your divorce settlement, see our divorce settlement calculator.

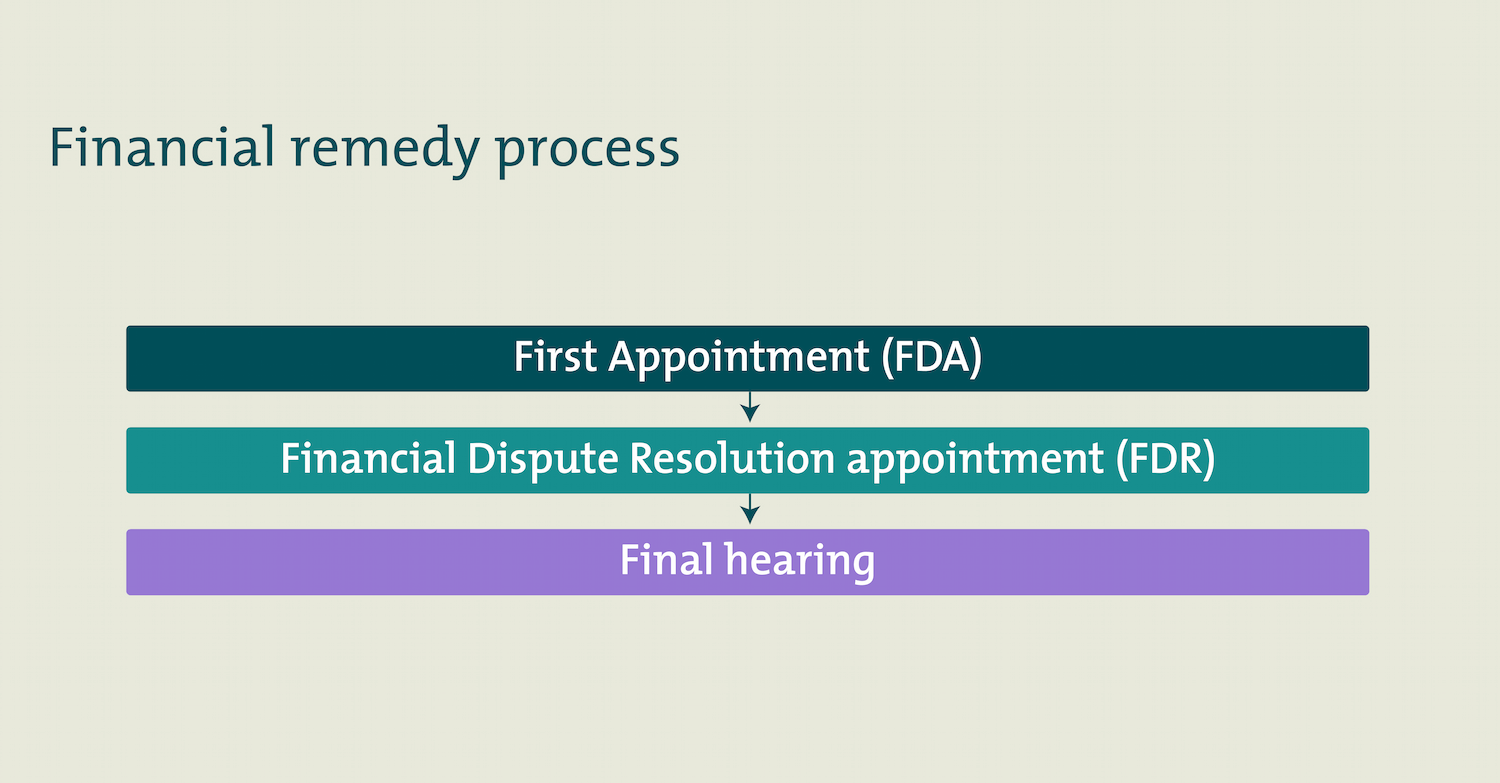

What is the procedure for financial remedy proceedings?

The financial remedy procedure can be split into four parts:

- Pre-court procedure;

- The first appointment;

- The financial dispute resolution (FDR) hearing;

- The final hearing.

1. Pre-court procedure

Before applying for a financial remedy order, the parties should first attempt to settle out of court.

Divorcing or separating couples are now required to consider mediation, with very few exceptions, before commencing court proceedings.

Mediation is a collaborative dispute resolution process where an independent third party attempts to help a couple reach an agreement on their own, avoiding court.

The first step is to attend a Mediation Information and Assessment Meeting (MIAM) where one of the parties will meet with a mediator to establish if the case is a good fit for mediation.

Some cases aren’t suitable for mediation. If the mediator decides that the case is not suitable for mediation, they will sign a certificate known as a MIAM certificate, which is given to your solicitor and will allow them to complete the application for a financial order.

If the mediator determines that your case is suited to mediation, they will explain your options and may suggest that you invite the other party to attend mediation with you.

Mediation can lower the cost of proceedings but it is not compulsory — you are only required to attend the MIAM.

Once you have attended a MIAM, your solicitor will prepare Form A which is the application for a financial remedy order.

2. The first appointment

A few weeks after your Form A has been issued, you will receive the notice of first appointment. This will set out the steps that you need to take before the first court hearing, known as the first appointment.

Before the first appointment, both parties to the financial remedy proceedings will need to fill out a Form E. This document asks for details of each party’s financial situation, including assets, debts, income, expenses, and any other relevant considerations. The parties then exchange the Forms E and file them with the court.

Before the first court hearing, both parties may prepare additional documents. These documents could include a list of any further information or documents needed, a timeline of important events and a summary of issues to be resolved in the case.

It is now quite common, if both parties are legally represented, to agree the directions to progress the case and therefore effectively not to proceed with the first appointment hearing itself. It is therefore sometimes possible to turn the first appointment into a financial disputes resolution (FDR) hearing.

The first appointment is a case management hearing where the judge will review the issues in the case and determine what further evidence is required.

After the first appointment, the judge may request further evidence such as:

- Replies to the questionnaires prepared by each party.

- A pension report.

- Valuations of property.

- Valuations of other assets such as companies, jewellery or artworks.

If both parties can agree to provide all evidence in writing, they may not need to attend the first appointment and the court can instead handle the case based on the submitted documents.

3. The financial dispute resolution (FDR) hearing

The financial dispute resolution hearing is the second court hearing that a separating couple attend. It is a negotiation hearing where discussions take place ‘without prejudice.’

Without prejudice means an interaction that is a genuine act of settlement, which will remain confidential and cannot be used in court as evidence of admissions against the party that made them.

The purpose of the FDR is to bring the parties out of the trenches to reach an agreement. By this stage, the proceedings will have been going on for a number of months and it should be clear what assets each party has and what the key issues are in the case.

Many cases will settle at, or shortly after, the financial dispute resolution hearing.

At the end of the hearing, the judge will provide an ‘indication’ which is essentially their view on what the likely outcome would be, were the matter to proceed to a final hearing. The indication is without prejudice and therefore could not be relied on in court at a final hearing.

Two weeks before the FDR, the parties must submit proposals outlining what they consider to be a fair financial settlement. These provide markers in the sand and it allows the judge in the FDR to see how far apart the parties are from reaching an agreement. When the judge provides their indication, they will provide an opinion on the proposals of each party and their likelihood of being successful at a final hearing.

It is also becoming increasingly common for couples to have private FDRs (using a privately funded judge, rather than a state funded judge). There are numerous benefits to doing so, including speed in securing a date for the hearing, being able to choose the judge and the location of the private FDR rather than having to attend court. It also means that because you can choose what time you start the FDR and the judge will be available all day, there is more time for the settlement negotiations and, resultantly, parties tend to have a higher likelihood of settling at a private FDR. The costs for the day will either be paid for by one party or split between both of them.

4. The final hearing

Most cases will not reach a final hearing as they will have often settled at, or before, the FDR stage. A final hearing is more in line with what many would consider to be a traditional court hearing.

Depending on the specifics of the case and the issues in dispute, either or both parties may be required to give evidence.

If there are any other points in dispute, the court may also hear evidence from some of the experts who have produced reports, such as the pension expert or forensic accountant.

After considering all relevant factors, the judge will issue a final decision outlining the financial arrangements for the couple. The decision will be recorded in the form of a financial remedy order.

Financial remedy orders, whether agreed upon through negotiation or decided by a judge, are legally binding once approved by the court. Both parties must adhere to the terms of the order, or face enforcement action.

Once an order is approved, neither party can bring any further claims against the other.

Do you need help?

Financial remedy proceedings can be complex and they will likely be a very difficult time for you. Taking advice from a family lawyer with experience in financial remedy proceedings is crucial.

For further information on financial remedy proceedings, contact our divorce financial settlement solicitors.